What is a credit report? What is a credit score? How can I improve my credit score?

Many people use the terms “credit report” and “credit score” interchangeably, but they are not the same. Your credit report is a detailed account of your credit history, while your credit score is a three-digit number signifying your creditworthiness. You are entitled to three free credit reports per year, but you generally have to pay to view your score. Although a credit score is a useful piece of information, it is ultimately calculated using the information in your credit report. Therefore, paying for a credit score is typically unnecessary, but ensuring the accuracy of the underlying data in the report is crucial.

What is a Credit Report?

Your credit report is a collection of all your credit activities within the past 7-10 years. It includes your payment history for credit cards and other loans such as auto loans and mortgages. It also includes public records related to your finances, such as bankruptcies, tax liens, and court judgments. Additionally, your report includes a record of everyone who has looked at it within the past two years. You can request one free credit report every year from each of the three main credit agencies—Equifax, Experian, and TransUnion. Companies use the information in your credit report to calculate credit scores.

What is a Credit Score?

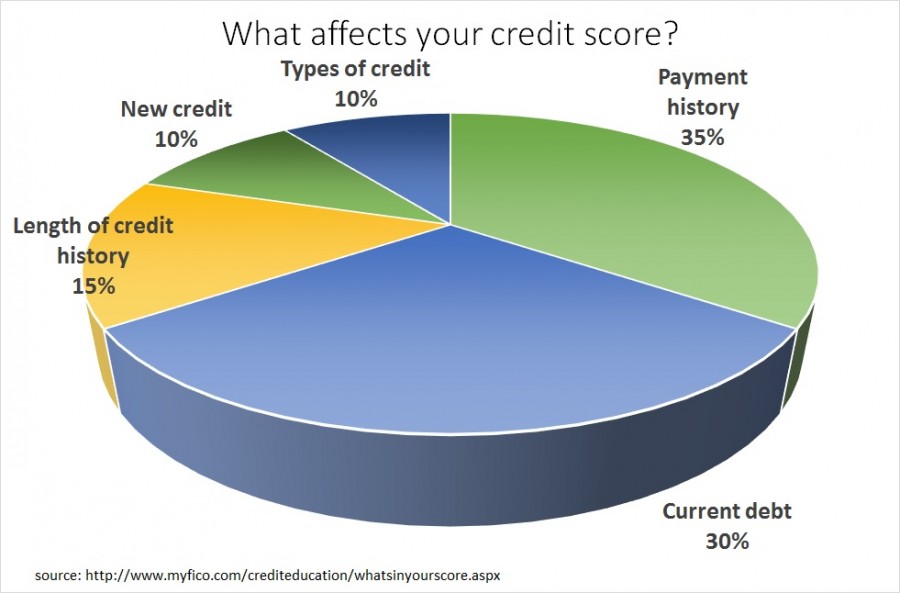

Your credit score is calculated using the information in your credit report. Financial institutions use your credit score to decide whether to offer you a loan or credit card. Your credit score also determines the interest rates and credit limits that financial institutions offer you. Although many people believe they have one credit score, in reality, everyone has several credit scores because different companies calculate them in different ways. Your scores change constantly based on your financial activities. Regardless of the agency, your score will consist of five main components: payment history, amount of current debt, length of credit history, amount of new credit, and types of credit used. Companies use each of these components to calculate a three-digit score, ranging from a low of around 300 to a high of around 900, which varies across different types of scores. In the United States, the most widely used credit score is the FICO score. Your credit score is not available for free through AnnualCreditReport.com.

How Can I Improve My Credit Score?

This UW-Madison Division of Extension guide provides detailed information about the factors that affect your score.

Your score consists of five main components: payment history, amount of current debt, length of credit history, amount of new credit, and types of credit used. Each of these elements does not carry the same weight.

Based on these categories, you can improve your score by paying your bills on time, using less of your available credit balance, not opening multiple credit accounts over a short period of time, keeping older credit cards open, and using different types of credit responsibly. Your credit score is based on behavior from the past seven-to-ten years, so the effects of negative actions will diminish over time.

Sources

- myFICO.com

- Consumer Financial Protection Bureau

- AnnualCreditReport.com

- Credit Report vs Credit Score Guide

*Several major credit card companies provide free credit scores to their customers. In addition, nonprofit organizations that offer credit counseling, housing counseling, and other forms of financial counseling services may now share credit scores with their clients. View this CFPB blog post for more information.

FAQs

Q: Are credit reports and credit scores the same thing?

A: No, credit reports and credit scores are not the same thing. Your credit report is a detailed account of your credit history, while your credit score is a three-digit number that represents your creditworthiness.

Q: How can I improve my credit score?

A: You can improve your credit score by paying your bills on time, using a smaller percentage of your available credit, avoiding opening multiple credit accounts in a short period, keeping older credit cards open, and using different types of credit responsibly.

Q: How often can I request a free credit report?

A: You are entitled to one free credit report every year from each of the three main credit agencies—Equifax, Experian, and TransUnion.

Q: Can I access my credit score for free?

A: Your credit score is not available for free through AnnualCreditReport.com. However, some major credit card companies provide free credit scores to their customers, and nonprofit organizations that offer financial counseling services may also share credit scores with their clients.

Conclusion

Understanding your credit report and credit score is crucial for managing your financial health. By regularly monitoring your credit report and taking steps to improve your credit score, you can have better control over your financial future. Remember, knowledge is power, so take advantage of the resources available to you and make informed decisions to build a strong credit history.