The world of startups often appears to embody the exceptionalism of modern finance, with funds swiftly flowing to the best teams and ideas wherever they may emerge. The reality, however, is much more complicated. Financing startups remains a daunting challenge for most economies, and filling the market with public funds has proven insufficient, if not counterproductive. In a recent article, I show that one of the main barriers to startup finance is an overlooked web of corporate law rules governing private companies’ boards, shares, and shareholders’ agreements, which I refer to as Startup Corporate Law or SCL.

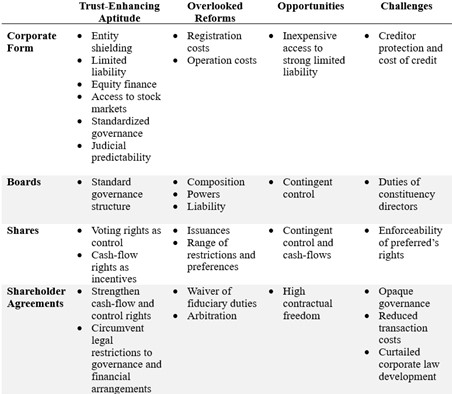

Changes to SCL shape the development of startup ecosystems and venture capital markets, either facilitating or discouraging founder-investor deals. But they are often hidden in plain sight, buried in broad legal reforms or technical judicial decisions that puzzle researchers and policymakers. Using a new comparative framework, I offer guidance on how to prevent well-intentioned policies from enabling the inefficient allocation of resources and poor governance practices in startup companies.

The Distinctiveness of Startups and Startup Corporate Law (SCL)

Startups are different from traditional small businesses in that they focus on developing scalable products and rapid expansion to disrupt or create new markets. This approach requires a recurrent influx of capital that conventional lenders are unable to provide. To finance their startups, entrepreneurs must convince investors that committing capital to a business venture can lead to enormous returns. At this stage, however, a founder’s main and most persuasive asset is an innovative idea, which is valuable only if kept secret, as established firms may be able to develop it faster. Specialized investors with an appetite for high returns may support an untested idea but will still demand scrutiny to determine the value and risks of a potential business venture. Thus, startup finance requires founders and investors to expose their assets and resolve their mutual distrust – or, better yet, to reach trust-enhancing agreements that enable collaboration and swift reaction to unforeseen challenges.

Corporate law determines how companies (including startups) are created, governed, and financed. Depending on its design, corporate law can facilitate or discourage founder-investor deals. How exactly corporate law leans one way or the other is surprisingly unclear due to a pervasive assumption that, for private companies, corporate law simply offers default terms that parties can easily customize.

In the article, I show that founder-investor agreements are fenced in by SCL – a web of corporate law rules that define how cash flow and control rights are distributed in non-listed corporations’ boards, shares, and shareholders’ agreements.

Using SCL to Explore and Explain Trends in Startup Finance

SCL can explain why some countries produce more startups backed by venture capital and have a prevalence of specific financial instruments. For example, the high costs of issuing shares in Germany are associated with comparatively higher levels of non-equity crowdfunding. Similarly, rigid rules limiting the rights that can be assigned to different types of shares in China led to the standardization of a trust-constraining financial agreement known as value adjustment mechanism. Within a given jurisdiction, selective SCL reforms can also explain changes in startup finance and governance. For instance, Mexico’s early-2000s reform expanding the ability to empower private corporations’ boards correlates with an increase in the rate of VC-backed startups in the following decade, including companies from other Latin American countries. My article provides guidelines on how to use the SCL framework to map the evolution of legal rules that constrain the range of founder-investor agreements and evaluate the trade-offs of potential reforms.

Startup Corporate Law

Addressing Emerging Challenges with SCL

Despite fierce competition to foster startups, SCL has evolved haphazardly and with little public scrutiny, generating new challenges that the proposed framework helps identify and address. Consider boards. Reforms enabling the class-based election of some board members support startup finance, expanding the range of trust-enhancing agreements between founders and investors. Shareholders with direct board representation may, for instance, relinquish cash flow or governance rights that can be allocated to other shareholders with different priorities or bargaining powers. Yet, whether these class-elected directors owe fiduciary duties to their electors, common shareholders, or both, and how they should ponder those interests when they diverge, are pressing challenges that too many policymakers miss. Although Delaware’s 2013 In Re Trados decision brought this issue to U.S. corporate law scholars’ attention (see, e.g., Pollman 2019 and Cable 2020), it remains unresolved and surprisingly ignored elsewhere. This is just one example of how experimentation on SCL can simultaneously expand the range of founder-investor agreements and generate potentially deal-breaking uncertainty. It reveals new opportunities to evaluate the pros and cons of changes in corporate law precipitated by the global rise of startups and VC.

Related SCL issues emerge from reforms expanding companies’ ability to issue multiple classes of shares with customized rights. Delaware’s characterization of preferred stock’s distinctive rights as “contractual” (i.e., subordinated to those of common stock) is not observed across jurisdictions, which suggests that U.S.-style agreements may give VCs stronger powers in other markets, as their entitlements would be protected by a property and not a liability rule (on this distinction see Sanga and Talley 2023). Other issues emerge from a global trend of using shareholders’ agreements to structure startup governance (Pereira 2023) and even to waive information and litigation rights (Rauterberg 2021, Fisch 2022).

Whether the promotion of startups and VCs justifies these types of changes in corporate laws and practices requires further scrutiny and reflection. That’s especially true when they facilitate opaque governance structures that diminish monitoring and accountability of companies with increasing social and economic significance. My article outlines problems across jurisdictions and research strategies on SCL to inform those necessary discussions.

This post comes to us from Professor Alvaro Pereira at Georgia State University College of Law. It is based on his recent article, “Designing Startup Corporate Law: A Minimum Viable Product,” available here.