A credit score is a three-digit number that provides a brief overview of an individual’s personal credit behavior. It significantly impacts important financial matters, such as whether or not you will be approved for lines of credit and loans.

A credit score is derived from the details in your credit report. These details are sensitive and include things like your name, your date of birth, your address, and your Social Security number. A credit score can have an impact on many aspects of your life, even if you aren’t a resident of the United States.

If you’ve recently moved to the U.S. and you don’t yet have a Social Security number (SSN), this article will discuss credit scores, why they’re important, and how you can establish your credit without a Social Security number.

What is a credit score?

A credit score is a three-digit number that reflects your credit history and is drawn from the information found on your credit report. Your credit report contains information pertaining to an individual’s financial history, such as the amount of debt they carry and how they have managed that debt. Loans, credit cards, phone bills, electric bills, and other utility bills, and even medical bills are all featured in a credit report.

This credit management behavior is reported to the three main credit bureaus in the U.S.: TransUnion, Experian, and Equifax. Whenever you open a credit card, take out a loan, or open any other financial account (including utility bills), that information is reported to the credit bureaus. The credit bureaus keep track of how to manage your debts when you make payments to pay back your debt. The information reported to the credit bureaus is compiled in a credit report, and that information is used to calculate your credit score.

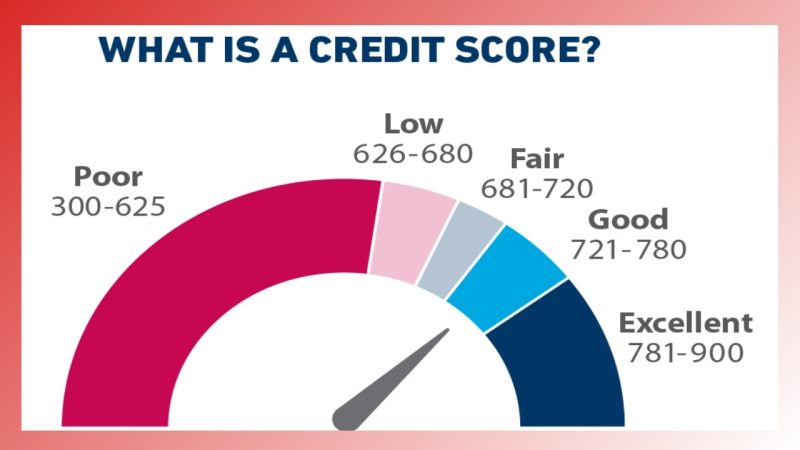

Credit scores from the major scoring providers typically range from 300 to 850. The numbers are assigned a value which ranges from “excellent” to “poor” and is broken down as follows:

- 800-850: Excellent

- 740-799: Very good

- 670-739: Good

- 580-559: Fair

- 300-579: Poor

The higher your credit score is, the better. Those who manage their debts responsibly receive a better credit score than those who don’t. For example, if you make payments on time and for the amount that is due, you don’t carry excessive amounts of debt, and you use your credit wisely, your credit score will be higher. However, if you carry a large amount of debt, you don’t make on-time payments, or if any of your accounts are not in good standing, your credit score will be negatively affected.

Why credit scores are important

Your credit score is important because it can impact your options and terms for financial products. Lenders and other financial institutions use your credit score, as well as the information found on your credit report, to determine your risk as a borrower. Those who have a high credit score are considered less risky because they are more likely to manage their debts responsibly; lenders will assume you’re more likely to repay the money you borrow in a timely manner. Individuals who have a low credit score are considered high risk because they are more likely to be irresponsible with their debt by making late payments, missing payments, or defaulting on loans.

Here are the top four reasons your credit score is important:

- It affects your ability to borrow money. The higher your credit score, the better your chances of being approved for a loan or a credit card will be. Additionally, a high credit score also affects the amount of money you’ll be able to borrow. A high score means you’ll be able to borrow more money, while a low score means that you will likely be able to borrow less (if you’re approved at all).

- It affects your interest rate. When you take out a loan or open a credit card, you’re charged an interest rate for any outstanding debt. The higher your credit score is, the lower your interest rates will be because lenders will consider you less of a risk. Borrowers with an unhealthy credit score can spend tens or even hundreds of thousands of dollars more in interest than those who have a healthy credit score.

- It affects insurance premiums. Your credit score can affect the premiums on car, health, homeowners, renters, life, and any other type of insurance. Like lenders, insurance companies take your credit score into consideration to assess your risk. If your score is high, for example, you will be deemed more responsible in paying your debts, which means you’re also more likely to drive safely, leading to a lower car insurance premium.

- It may affect your access to utilities. Many utility providers like phone, Internet, and cable companies check credit history prior to opening new customer accounts. Depending on their policies, you may be required to pay more for the service if your credit score is low. For example, you might be asked to pay a security deposit if your credit score is low.

Can you have a credit score if you don’t have a Social Security number?

The credit bureaus use sensitive information to keep track of your credit history. This information includes your Social Security number, your name, your date of birth, your address, and your employment history. While a Social Security number is a common identifier that credit bureaus use to locate and collect your information, it’s only one of several identifiers. If you do not have a Social Security number, credit bureaus can access your credit history using the other identifiers like your name, date of birth, address, and employment history.

While a Social Security number does improve the accuracy of matching credit history with a consumer, a Social Security number is not required to create a credit report and an accompanying credit score.

How to establish a credit score without a Social Security number

If you have recently moved to the U.S. you can still establish a credit score without a Social Security number. Below, we’ll look at some of the most common ways:

Get a credit card

One of the best ways to establish a credit score without having an SSN is by getting a credit card. Credit card companies are the largest sources of customer payment histories, and they report these histories to major credit bureaus. If you have a credit card account, that account will be reported to the credit bureaus and the credit bureaus will use available personal identifiers to compile a credit report. If you don’t have a Social Security number, these identifiers include your name, date of birth, address, and employment history.

New applicants are often asked to provide a Social Security number when applying for a credit card as it helps to verify the identity of applicants.

However, you do not always need a SSN to get a credit card. Several issuers, such as American Express, allow applicants to apply for credit cards using an Independent Taxpayer Identification Number (ITIN) instead.

Once you secure a credit card, make sure you manage it responsibly. Avoid carrying a high balance and make your payments on-time. Responsibly managing your credit card debt will allow you to achieve a healthy credit score.

Borrow money

You can also build credit and develop a credit score by taking out a loan. Like a credit card, some financial institutions will allow you to take out a loan without a Social Security number. You may be able to use an Individual Taxpayer Identification Number, passport number, an alien identification number, or government-issued identification instead. You should check directly with financial institutions to find out what type of identification they require.

Once you take out a loan, information pertaining to your account will be reported to the credit bureaus, and therefore, you will be able to establish your credit and get a credit score. In order to achieve a healthy credit score, make sure you properly manage your loan. Make payments in a timely manner for the amount that is due, and pay it off within the loan terms. If possible, paying your loan off early may improve your credit score. However, before prepaying, make sure you check with the lender, as some institutions do charge penalties and fees for pre-payment on some loans.

Be responsible with utilities

Credit card companies, banks, and credit unions aren’t the only institutions that report your information to the credit bureaus; utility companies do too. Cell phone, electric, cable, internet, and other utility providers may report the information related to your accounts to the credit bureaus. By simply having an account with any of these service providers, you can build your credit and acquire a credit score without needing an SSN.

Keeping track of your credit score

Once you have established a credit history and a credit score, it’s important to keep track of both. While living in the U.S, your credit score will have a big impact on your financial well-being and ability to secure certain services.

Regularly checking your credit report will not only let you assess your financial standing but also allow you to address any potential issues. For example, if your credit report contains information that doesn’t relate to you – a credit card that was opened in your name that you never opened or charges to your accounts that you never made – it could be a sign of identity theft. Credit reports can also reflect inaccuracies, such as late payments made on time or missed payments that you actually made. These inaccuracies can negatively impact your credit score and your financial well-being.

If you spot any issues with your credit history, you can file disputes with the credit bureaus. Make sure that you have the necessary documentation to back your disputes (paid bills and canceled checks for payments made, for example). Once any disputes are rectified, your credit score will go up.

How Nova Credit can help you establish credit

Whether or not you have an SSN, a credit score is an important part of your life in the U.S. You will need it to apply for credit cards, loans, apartment rentals, and other essentials once you’ve moved to the U.S.

Fortunately, Nova Credit lets you use your foreign credit history from certain countries to apply for several of these essential products and services from our partners.

This means that you can apply for great credit cards, phone plans, and more using your hard-earned credit history from back home—rather than needing to start from scratch. If you are approved for these products and manage them responsibly, you will start to quickly build a U.S. credit history.

Currently, Nova Credit serves individuals coming from Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Spain, Switzerland, and the U.K.

More from Nova Credit:

Credit Cards for No Credit

Credit Cards for International Students

Credit Cards Without SSN

Credit Cards to Build Credit

How to Build Credit

How to use your foreign credit history to get credit in the U.S.