Bitcoin mining has become a hot topic in recent years, thanks to the surge in popularity and value of cryptocurrencies. But what exactly is Bitcoin mining and how does it work? In this article, we’ll delve into the basics of Bitcoin mining, its statistics, and the key risks associated with it.

Understanding Bitcoin

Bitcoin is a type of cryptocurrency, a digital medium of exchange that operates solely online. It runs on a decentralized computer network called blockchain, which tracks and verifies transactions. When these transactions are processed and verified by miners, new bitcoins are created. Miners receive payment in Bitcoin for their processing efforts.

How Bitcoin Mining Works

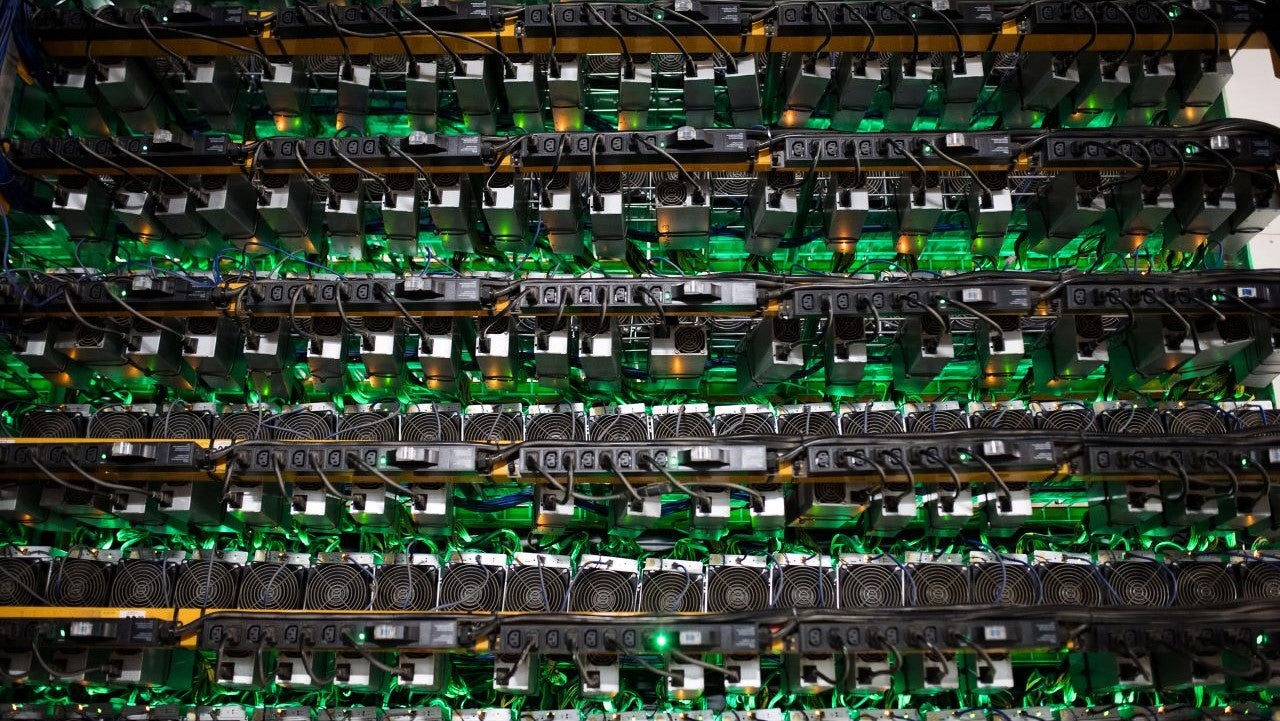

Bitcoin mining involves solving complex mathematical problems using powerful computers and significant amounts of electricity. Miners compete to arrive at the correct or closest answer first. This process, known as proof of work, requires substantial computing power.

The hardware required for Bitcoin mining is called application-specific integrated circuits (ASICs), which can be quite expensive, costing up to $10,000. Additionally, ASICs consume massive amounts of electricity, which has drawn criticism from environmental groups and affects the profitability of mining.

If a miner successfully adds a block to the blockchain, they receive a reward of 6.25 bitcoins. However, this reward amount is halved roughly every four years. As of November 2023, with Bitcoin trading at around $36,400, 6.25 bitcoins would be valued at $227,500.

Is Bitcoin Mining Profitable?

The profitability of Bitcoin mining depends on various factors. Despite the potential rewards, the high upfront costs of equipment and ongoing electricity expenses make it challenging for many miners to turn a profit. In fact, the electricity consumption required for mining is substantial. It is estimated that Bitcoin mining consumes about 147 terawatt-hours of electricity annually, more than most countries.

One way to mitigate the high costs of mining is by joining a mining pool. These pools allow miners to pool their resources, increasing their capability. However, shared resources also mean shared rewards, resulting in potentially lower payouts. Furthermore, the volatility of Bitcoin’s price makes it difficult to determine the exact value of the rewards.

How to Start Bitcoin Mining

To start mining Bitcoin, you’ll need a few essentials:

-

Wallet: A secure online account to store and manage your earned bitcoins. There are various wallet options available from companies like Coinbase, Trezor, and Exodus.

-

Mining software: Download and install mining software that can run on your computer. Several providers offer free mining software compatible with Windows and Mac.

-

Computer equipment: Acquire a powerful computer that can handle the immense computational requirements of mining. The cost of this hardware can reach $10,000 or more.

Risks of Bitcoin Mining

Bitcoin mining comes with its fair share of risks, including:

-

Price volatility: Bitcoin’s price has been highly volatile since its inception. The uncertainty surrounding its value makes it challenging for miners to determine if their rewards will offset the high costs of mining.

-

Regulation: Cryptocurrencies like Bitcoin operate outside government control, leading many governments to view them with skepticism. There is always a risk that mining Bitcoin or cryptocurrencies could be outlawed, as was the case in China in 2021.

Taxes on Bitcoin Mining

It’s important to consider the tax implications of Bitcoin mining. If mining is your business, you may be able to deduct incurred expenses for tax purposes. Mined bitcoins are considered income and are taxed at ordinary income rates. Capital gains tax applies if you sell bitcoins at a higher price than when you received them.

FAQs

Q: Is Bitcoin mining profitable?

A: Bitcoin mining can be profitable for some, but the high upfront costs of equipment and ongoing electricity expenses make it challenging for many miners to turn a profit.

Q: How much electricity does Bitcoin mining consume?

A: Bitcoin mining consumes about 147 terawatt-hours of electricity annually, surpassing the electricity consumption of many countries.

Q: What are the risks of Bitcoin mining?

A: The risks of Bitcoin mining include price volatility and potential regulatory restrictions imposed by governments.

Conclusion

While Bitcoin mining may seem enticing, it is a difficult and expensive endeavor. The extreme volatility of Bitcoin’s price adds further uncertainty to the equation. It’s crucial to remember that Bitcoin itself is a speculative asset with no intrinsic value. Its value relies on selling it to someone else at a higher price, which may not always be possible or profitable.